Anatomy Of A Trade

Trades are typically documented using one format. Here is how I document a trade.

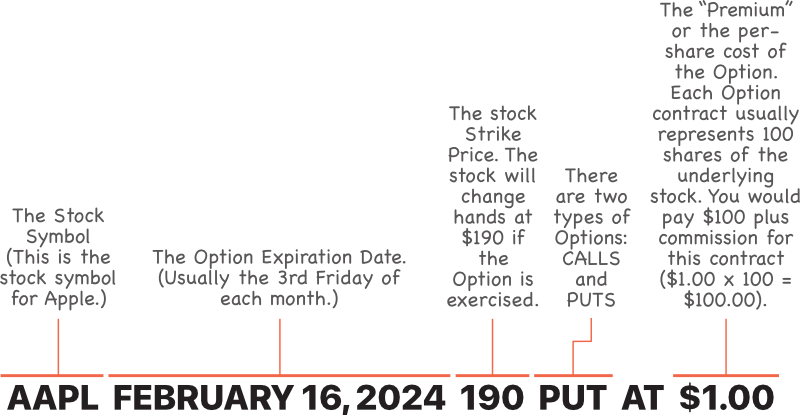

Trades are typically documented using the format shown in the illustration.

- The Stock Symbol

- The Expiration Date

- The Stock Strike Price

- The Option Type: Call or PUT

- The Premium: The per share cost of the option.

Here is how I document a trade. I also keep a record in my Trade Log:

Sell To Open | AAPL | Qty: 2 | Short Put Spread | Expires: Apr 19, 2024 | Buy: $165 / Sell: $170 | Net Price: $1.84 | Credit: $368 | Close Target: 10¢ | Profit Target: $358

Sell To Open or Buy To Close: Terms used to describe an option transaction. Other terms are: Sell To Close and Buy To Open.

AAPL = Apple Stock Symbol

QTY: The number of options sold or bought.

Short Put Spread: The name of the option Play used.

Expires = The option expiration date.

Buy/Sell: The prices paid for each “Leg” of the trade (the buy leg and the sell leg).

Net Price = The difference between the Buy/Sell prices.

Credit = The amount received from the sale of an option position.

Debit = The amount paid to buy an option position.

Close Target = The amount you want to pay or receive to close (exit) an option position.

Profit Target = The net profit or loss you have after closing an option position.