How To Copy My Trades

I want my subscribers to learn how I trade and to make money trading. That’s entirely the point of this website.

To that end I want to provide some clear guidance to my subscribers on how precisely you can follow my trades and make money trading like I do.

Everything You Read On This Site Already Happened

Keep in mind is that by the time you read about a trade I made on this website, whatever was happening in the market when I made that trade already happened, and is in the past. This is an essential concept to keep top of mind before you make your own trades.

I trade monthly options, so generally the strategy I had in mind when I made a trade may still be relevant when you read about that trade here on this site – assuming you read my posts daily. That said, the market changes fast. So it is absolutely vital that you check current market conditions before you make a trade. To put this important point another way... NEVER copy a trade I made without checking the current market conditions first.

Check Current Market Conditions

What do I mean by check current market conditions?

By check current market conditions I mean check the current stock price and how the stock price is moving currently.

Here are two specific questions to ask and get answers to:

- Is the stock price up or down from the price I show in my post?

- By how much? (Formula: Current Stock Price - Price I show in my post = The Difference (+/-))

Knowing if the stock is moving up or down is very important. Remember my favorite trade and the trade I make 95% of the time is a Short Put Spread. This means I bet on the stock price being above a certain price when the option expires.

Trade Out-Of-The-Money

I like to trade safely Out-Of-The-Money by selecting an option Strike Price that is at least $10 below the current Stock Price when I place my open trade. This allows room for the price of the stock to fall a full $10 before I have to worry about my trade. Note that this does happen occasionally. When it does happen, stay calm and check out my post titled How To Roll An Option.

How To Follow My Trades

As I’ve mentioned it is important to check current market conditions before making a trade. After doing this, make a trade based upon current market conditions.

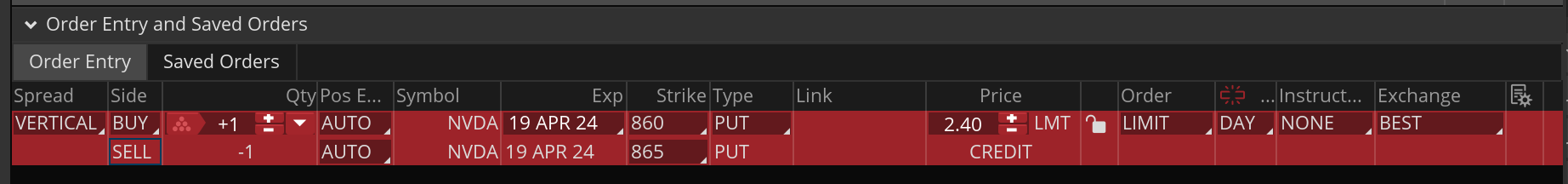

For example, today Nvidia (NVDA) closed at $884.55. Tomorrow morning I would select an $860 Strike price for the first BUY leg, and a $865 Strike price for the second SELL leg of a Short Put Spread. I would go $20 Out-Of-The-Money on a Nvidia stock trade because that stock makes wide move swings ($10-$30 in a day). Here’s that trade:

Sell To Open | NVDA | Qty: 1 | Short Put Spread | Expires: Apr 19, 2024 | Buy: $860 / Sell: $865 | Net Price: $2.40 | Credit: $240 | Close Target: 10¢ | Profit Target: $230

I like this trade. It pays $240 up front and bets that NVDA will be at or above $865 on Apr 19th. NVDA is on a roll, and I think this is a sound trade. Also, there is a decent chance the 10¢ profit target could be reached for this trade a few days before expiration, depending on how far above $865 the stock price rises.

I trust you can see why it is important to check current market conditions before making trades. And I hope this helps you take advantage of what you learn from my trades to make profitable trades of your own. Contact me with questions.

Happy trading!