Trade Rollout 2

The AAPL Rollout trade I made last week is set to expire tomorrow on Friday, March 22nd. To prevent taking a full loss tomorrow, I rolled out the trade today.

The AAPL Rollout trade I made last week is set to expire tomorrow on Friday, March 22nd. The bet was that the price of Apple (AAPL) would be at or above $180 on March 22nd. As I write this post Apple shares are down at $171.30.

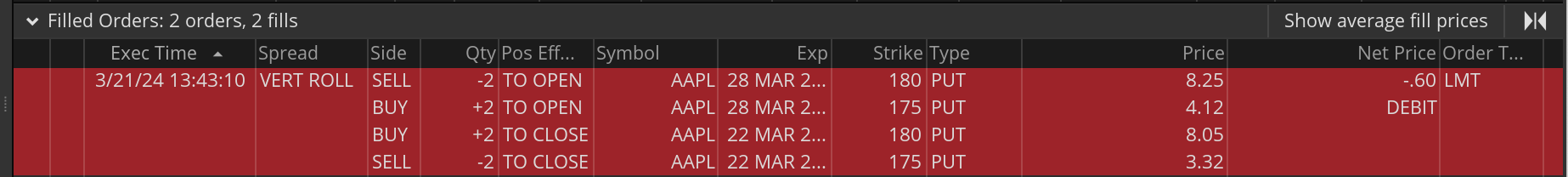

To prevent taking a full loss tomorrow, I rolled out the trade today. Here’s the Roll Trade:

Buy Roll | AAPL | Qty: 2 | Short Put Spread | Expires: Mar 28, 2024 (Quarterly) | Buy: $175 / Sell: $180 | Net Debit: 60¢ | Debit: $120

Notice the option type changed from Weekly to Quarterly, and the expire date changed from Mar 22nd to Mar 28th.

This second Roll trade costs another $120 that comes out of any profit that may be made on the original trade. The key to remember is I have not lost money on the trade. That is the power of Rolling a trade.

The point of trading is to make more profitable trades than unprofitable trades over time. My plan now for this trade is to wait till Mar 27th and close the trade (even at a loss.) I’ll live to trade another day.